William Fazioli, Executive Director

Rhode Island Infrastructure Bank

Rhode Island Infrastructure Bank

Learn about the latest News & Events for RI Infrastructure Bank, and sign up to receive news updates.

Add this issuer to your watchlist to get alerts about important updates.

Learn about the latest News & Events for RI Infrastructure Bank, and sign up to receive news updates.

Please click the link below the view our news section.

PROVIDENCE, R.I. – Rhode Island Infrastructure Bank, the state’s central hub for financing infrastructure improvements for municipalities, businesses, and homeowners, has issued a $41,630,000 Clean Water State Revolving Fund bond, with $5,200,000 in principal forgiveness stemming from the Bipartisan Infrastructure Law (e.g., a grant). Bond proceeds will help finance the ongoing construction of the Narragansett Bay Commission’s Combined Sewer Overflow (CSO) Phase III project and other system infrastructure upgrades. The 30-year bond met with strong investor demand that netted an attractive overall borrowing rate of 3.93% and is rated AAA by S&P and Fitch Ratings.

“For the past 20 years, Rhode Island Infrastructure Bank has been providing low-cost financing for the Narragansett Bay Commission’s CSO project, and we’re pleased to continue that partnership with this $41 million bond to support Phase III construction and other system upgrade projects,” said William Fazioli, Executive Director. “The CSO is one of the largest infrastructure projects in Rhode Island’s history and has produced dramatic improvements in the health of Narragansett Bay. It is an excellent example of what is possible through investing in infrastructure and utilizing Rhode Island’s Clean Water State Revolving Fund program.”

“Our CSO project would not have been possible without the low-cost financing provided by the Rhode Island Infrastructure Bank,” said Narragansett Bay Commission Executive Director Laurie Horridge, Esq. “We thank the Bank for their decades-long partnership and for this latest $41 million Clean Water State Revolving Fund financing for CSO Phase III work, and other upgrades to our system infrastructure.”

“By utilizing the Bank’s capital and below market rate financing on this bond issue, Narragansett Bay Commission was able to save $24 million versus borrowing via traditional options,” said Rhode Island Infrastructure Bank Board Chair Vahid Ownjazayeri. “Including this bond, Rhode Island Infrastructure Bank has provided approximately $900 million in Clean Water State Revolving Fund financing for Narragansett Bay Commission clean water infrastructure investments. We are proud of this long-term partnership, which demonstrates the power public infrastructure investment can have in improving public health and the health of our environment.”

Since 2003, the Narragansett Bay Commission has used the Bank’s low-cost Clean Water State Revolving Fund program to complete Phase I and Phase II of the CSO project, diverting more than 1 billion gallons of combined water and wastewater that would have otherwise gone straight into Narragansett Bay, and is now treated at their Field’s Point Wastewater Treatment Facility each year. The project has helped to dramatically improve the health of Narragansett Bay.

Phase III of the Combined Sewer Overflow project, currently under construction, is a 2.2-mile long, 30-foot diameter tunnel running underneath Pawtucket and Central Falls that is expected to reduce overflow volumes by 98 percent and treat stormwater before it flows into Narragansett Bay.

The financing team that led this highly successful transaction included Ramirez & Co as Senior Managing Underwriter, Hilltop Securities as Financial Advisor, and Hinckely Allen as Bond Counsel.

PROVIDENCE, R.I. – Rhode Island Infrastructure Bank today announced that leading rating agencies Fitch and S&P have both given AAA, outlook stable credit ratings to the Bank.

“Receiving these AAA credit ratings is a testament to the strong financial foundation we have built, and Rhode Island Infrastructure Bank’s resilient fiscal condition,” said Executive Director William Fazioli. “The stable outlook also demonstrates the rating agencies’ confidence that the Board and Management will continue to enact policies and procedures that will benefit our borrowers, Rhode Island taxpayers, and ensure the Bank is able to provide a source of capital to support a clean and healthy environment for generations to come.”

“Our Clean and Drinking Water State Revolving Fund programs provide hundreds of millions of dollars in needed low cost financing for stormwater, wastewater, and drinking water projects in cities and towns across Rhode Island,” said Rhode Island Infrastructure Bank Board Chairman Vahid Ownjazayeri. “With these AAA credit ratings, Rhode Islanders can be confident that the Infrastructure Bank is highly credit worthy and extremely vigilant in the use of public funds to improve critical infrastructure in our state.”

PROVIDENCE, R.I. – Rhode Island Infrastructure Bank, the state’s central hub for financing infrastructure improvements for municipalities, businesses, and homeowners, today announced that Anthony Hebert will join the Bank as a Business Development Officer. The Bank also announced the promotions of Anna Coelho Cortes to Managing Director of Business Development and Ken Viera to Deputy Chief Financial Officer.

“We are pleased to announce the hiring of Anthony Hebert as a Business Development Officer,” said William Fazioli, Executive Director of Rhode Island Infrastructure Bank. “Anthony’s experience in municipal economic development will be a strong asset as he assists us in reaching out to our city, town, and quasi-public partners. We are also pleased to share that two of our talented employees, Anna Coelho Cortes and Ken Viera are being promoted to the positions of Managing Director of Business Development and Deputy Chief Financial Officer, respectively.”

Continued Fazioli, “Anna has been with the Bank for 25 years, progressively taking on more responsibility each year and has developed an unmatched level of expertise regarding the Bank’s wide range of financing programs. As our Managing Director of Business Development, she will play a critical role in ensuring that our city and town partners are aware of and utilize the Bank’s broad financial solutions designed to meet infrastructure needs.”

“Ken has been with the Bank since 2017, overseeing internal controls, assisting with budget preparation, financial reporting and managing the Bank’s strong capital position. We’re pleased to promote him Deputy Chief Financial Officer, particularly as the Bank manages an influx of nearly $400 million in federal Bipartisan Infrastructure Law funding for projects across the state,” concluded Fazioli.

Anthony Hebert grew up in Sutton, Massachusetts and holds a Master’s Degree in Public Administration from Bridgewater State University. Anthony is joining the Infrastructure Bank as a Business Development Officer focused on launching new programs under the bank’s expanding portfolio. Prior to joining the Rhode Island Infrastructure Bank, Anthony spent 5 years working for the City of Pawtucket in their planning department and, most recently, in their commerce department as the City’s Economic Development Officer where he managed small business initiatives, advanced community development and infrastructure projects, and facilitated the financing to grow local business and foster tourism.

PROVIDENCE, R.I. – Rhode Island Infrastructure Bank, the state’s central hub for financing infrastructure improvements for municipalities, businesses, and homeowners, today announced that Joanna L’Heureux has been named the Bank’s new Chief Financial and Operating Officer.

“Joanna L’Heureux brings more than 30 years of experience in public finance, accounting and strong leadership qualities to the table, and we’re thrilled to have her join the Bank as our new Chief Financial and Operating Officer,” said William Fazioli, Executive Director of the Infrastructure Bank.

“We are pleased to welcome Joanna to the Infrastructure Bank team at a critical time for the Bank and the cities, towns, and quasi-public entities we serve,” said Vahid Ownjazayeri, Chair of the Rhode Island Infrastructure Bank’s Board of Directors. “Her public finance background and strong relationships with local municipalities will be invaluable as we work to ensure our municipal partners are aware of and able to access the approximately $400 million in federal Bipartisan Infrastructure Law funding coming into our state for wastewater, drinking water, lead pipe replacements, and other critical infrastructure projects.”

Joanna L’Heureux has over 30 years of municipal finance experience in both the private and public sectors. She previously served as the Finance Director for the City of Pawtucket for 10 years and most recently as the Chief Financial and Administrative Officer for the Rhode Island Interlocal Risk Management Trust. Her experience includes working as an independent auditor with two CPA firms specializing in auditing municipalities and school districts in Rhode Island and Massachusetts. Joanna earned a BS degree in Business Administration with a concentration in accounting from Bryant University.

PROVIDENCE, R.I. – The Board of the Rhode Island Infrastructure Bank today announced the appointment of William J. Fazioli as CEO and Executive Director of the Bank. The appointment of Mr. Fazioli follows the departure of Jeffrey R. Diehl who, as Chief Executive Officer and Executive Director of the Bank, provided more than 7 years of dedicated public service to the Bank and the citizens of Rhode Island.

Mr. Fazioli, who most recently served as the Bank’s Managing Director of Program and Business Development, has over 35 years of public administration experience in municipal finance, economic development, and infrastructure investment. Well-known and respected by state and municipal leaders, Bill previously served as Northeast Regional Director for BondLink, a public finance investor relations portal, and prior to that was Director of Planning & Economic Development for the City of East Providence. His background includes senior roles in public sector banking, financial advisory, and municipal government. He is also the Executive Director of New England States Government Finance Officers Association and Chair of the East Providence Waterfront District Commission. Bill earned an MPA degree in public finance from SUNY-Albany and a BA in public administration and sociology from Rhode Island College.

“On behalf of the Board, I want to thank Jeff for his valued service in leading Rhode Island Infrastructure Bank,” said Board Chair Vahid Ownjazayeri. “Under Jeff’s leadership, the Bank invested hundreds of millions of dollars to assist Rhode Island municipalities, businesses, and not-for-profit organizations to facilitate and to help bring down the costs of highly significant infrastructure projects. During Jeff’s tenure and under his leadership, the Bank experienced tremendous growth in its financing of critical water and transportation infrastructure. as well as renewable energy, municipal resilience, and energy efficiency projects, all areas critical to the future of our State. We wish Jeff all the best and continuing success in his future endeavors.” Chair Ownjazayeri concluded, “We’re excited to have Bill as our new Executive Director. We believe his experience and expertise make him well-suited to build upon the Bank’s many successes and to lead the Bank to further its mission to serve many important needs of our State.”

PROVIDENCE, R.I. – Rhode Island Infrastructure Bank is applauding the Governor and General Assembly for funding several infrastructure priorities in the FY 2024 state budget including:

$5.5 million for the Municipal Infrastructure Grant Program (MIGP) – Originally created by the General Assembly in 2021, the MIGP has awarded $3.5 million in grant funding to 9 cities and towns across the state. This funding included in the FY23 supplemental budget is for the Bank to establish a Municipal Matching Grant Pool of funds to assist cities and towns in providing the local match for federal funding opportunities under the federal Bipartisan Infrastructure Law.

$28.5 million in state matching funds for the Clean Water State Revolving Fund and Drinking Water State Revolving Fund – Thanks to the federal Bipartisan Infrastructure Law, Rhode Island’s Clean Water State Revolving Fund and Drinking Water State Revolving Fund are set to receive nearly $400 million in federal funding over the next several years. The $28.5 million included in the FY 2024 budget is the required state match to unlock a portion of these federal funds.

$4.3 million for support infrastructure necessary for affordable housing development – Rhode Island Infrastructure Bank will work in coordination with the Rhode Island Department of Housing to provide funding to cities and towns to support the infrastructure necessary to support affordable housing development, such as road and utility infrastructure.

“We thank Governor McKee, Speaker Shekarchi, and Senate President Ruggerio for prioritizing key infrastructure investments in this year’s state budget,” said Jeffrey Diehl, CEO of Rhode Island Infrastructure Bank. “From assisting our city and town partners in completing local projects, to unlocking hundreds of millions in federal funding for clean and drinking water projects across the state, to making sure local infrastructure can support the development of new affordable housing projects, these are smart investments that will benefit our communities, residents, businesses, and the environment.”

PROVIDENCE, R.I. – Rhode Island Infrastructure Bank has closed on a $77,260,000 Green Bond to support clean water projects for the Narragansett Bay Commission and the communities of East Greenwich, East Providence, Middletown, Woonsocket, and Warwick, and for drinking water projects in the City of Providence.

“Thanks to the Bipartisan Infrastructure Law, Rhode Island’s Clean and Drinking Water State Revolving Funds are receiving nearly $400 million in funding for projects across the state,” said Jeffrey Diehl, CEO of Rhode Island Infrastructure Bank. “We are using this bond sale to speed up the flow of financing so our cities, towns, and quasi-public entities can get to work on major infrastructure projects. Projects like upgrading wastewater treatment plants, building new pump stations, installing new sewer mains, and repairing and replacing drinking water mains, transmission lines, and service lines. These projects are essential to our communities, residents, and businesses who rely on often unseen but absolutely critical drinking water, sewer, and stormwater infrastructure.”

Projects receiving Green Bond proceeds:

Narragansett Bay Commission – Combined Sewer Overflow Phase III, Fields Point Wastewater Treatment Facility upgrades, and other upgrade and replacement projects – $47.6 million.

East Greenwich – Wastewater treatment plant facility upgrades – $4.9 million.

Woonsocket – Replacement of Manville Road pump station and repairs at Woonsocket Regional Wastewater Treatment Facility – $2.3 million.

Middletown – Replacement of Paradise Avenue Pump Station Force Main – $1 million.

Warwick – Rehabilitation of Cedar Swamp Force Main and completion of sewer installation to bring sewer availability to the city’s Bayside neighborhood – $20 million.

East Providence – Water pollution abatement and resiliency improvements to Booth Avenue and Bold Point Park areas – $2.5 million.

Providence / Providence Water Supply Board – Water distribution improvements including cleaning, relining, repair and replacement of water mains, transmission lines, service lines, and valves – $5.5 million.

The bond received a rating of AAA from Fitch and AAA from S&P Global Ratings.

Infrastructure Bank Announces $4.9 Million

for Municipal Resilience Program Action Grants and Names 6 Municipalities to Participate in 2022 Program Round

Cities and towns will implement specific projects to address impacts of climate change

PROVIDENCE, R.I – Rhode Island Infrastructure Bank today announced $4.9 million in Action Grants for participants of the Municipal Resilience Program (MRP). Communities prioritized local actions through the program and will use grant funds to implement projects that will increase their climate resilience.

“The Infrastructure Bank stands by our commitment to Rhode Island’s municipalities to accelerate investment in critical infrastructure and nature-based solutions that will better prepare communities for a changing climate” said Jeffrey R. Diehl, CEO of Rhode Island Infrastructure Bank. “The Bank’s Municipal Resilience Program directly supports cities and towns to identify and fund priority resilience projects, with a particular focus on nature-based solutions and those benefitting disadvantaged communities. We look forward to building on the success of the first three rounds of the program and strengthening relationships with our municipal partners statewide to proactively address climate change.”

With support from The Nature Conservancy, 20 municipalities have completed Community Resilience Building workshops and developed prioritized lists of actionable resilience plans and projects. Municipalities are then eligible to submit applications for MRP Action Grants with a 25% local match requirement. After a competitive review process, the selection committee recommended the following proposals to receive funding for implementation:

● Barrington - Shoreline adaptation and upgradient tree planting at five sites for water quality, flood reduction, and heat reduction benefits; in addition, improvements at the Municipal Tree Nursery to support street tree populations across town

● Bristol - Green infrastructure at Independence Park to improve water quality, reduce flooding, and create safer public access

● Central Falls & Pawtucket - Two parklets, one in each City, along the Pine Street corridor in the Pawtucket-Central Falls Transit Oriented Development District, which will incorporate green infrastructure for water quality and flood reduction benefits

● Cumberland - Planting of 196 trees at 26 locations throughout the Valley Falls and Lonsdale neighborhoods for stormwater management and cooling benefits

● Cumberland - Enhancement of Cumberland’s stormwater management system along Industrial Road, incorporating a combination of green and gray infrastructure techniques

● East Providence - Stormwater management installations incorporating green infrastructure at Beach Road and Willet Pond and floodproofing of the Silver Street Pump Station

● Newport - Shoreline adaptation and green infrastructure installations at the end of Pine Street to improve water quality, reduce flooding, control erosion, and increase public access to the waterfront

● North Kingstown - Shoreline adaptation and green infrastructure at the end of Roger Williams Drive, providing water quality, flood reduction, and erosion control benefits

● North Kingstown - Flooding solutions at the Brown Street Parking Lot in Wickford Village, utilizing green infrastructure and elevation to address both water quality and flooding concerns

● Portsmouth - Stormwater injection facility and green infrastructure at Riverside Street and dredging at Founders Brook to remove silt and vegetation buildup without hardening or channelizing the watercourse to address water quality concerns and reduce flooding

● Providence - Green infrastructure “treatment train” at Mashapaug Pond that will address water quality concerns and allow for the testing of innovative stormwater management methods

● Providence - Emergency generators at the Davey Lopes Recreation Center and the Elmwood Community Center to allow these centers to provide shelter during storm and extreme temperature events, and as a first step to establishing these centers as Resilience Hubs, which will provide information & engagement on climate resilience and transition to clean-energy systems in line with City-wide resilience goals

● Tiverton - Restoration of natural hydrological patterns, relocation of vulnerable infrastructure, and creation of sand dunes stabilized with beach grass at Fogland Beach, Fogland Marsh, and Three Rod Way to address flooding concerns and protect against storm surges

● Warren - Installation of stormwater management green infrastructure at Fern Drive to provide water quality treatment and reduce flooding

● Westerly - Installation of nature-based stormwater infrastructure along Main Street, serving as a nature-based solution demonstration that will improve water quality, reduce flooding, reduce heat, and increase green space

The Bank also named six municipalities to participate in the 2022 round of the MRP. This is the fourth round of the program and increases the number of participating communities to 26.

Selected 2022 municipalities:

● Burrillville

● Charlestown

● Glocester

● Lincoln

● Narragansett

● Richmond

“Municipalities across the state are already feeling the impacts from climate change – from increased damage from storms to rising sea levels,” said Sue AnderBois, The Nature Conservancy’s Climate and Energy Program Manager. “The Nature Conservancy is proud to have partnered with the Infrastructure Bank to bring these planning workshops to 20 of the state’s 39 municipalities already, and we are so pleased to see the municipalities taking advantage of these initial grants to implement the recommendations of their workshops. We know there continues to be additional need for this type of planning and implementation. The proposed Green Bond includes an additional $16 million for implementation grants, and we are working with our colleagues across the region to determine how we can leverage federal infrastructure funds here in Rhode Island.”

All Rhode Island cities and towns are eligible to apply for the Municipal Resilience Program. More information on the program can be found here.

About Rhode Island Infrastructure Bank

Rhode Island Infrastructure Bank is Rhode Island’s central hub for financing infrastructure improvements for municipalities, businesses, and homeowners. We leverage capital in a revolving fund to offer innovative financing for an array of infrastructure-based projects including water and wastewater, road and bridge, energy efficiency and renewable energy, and brownfield remediation. These quality of life projects improve the State’s infrastructure, create jobs, promote economic development and enhance the environment. For more information, please visit www.riib.org.

About The Nature Conservancy

The Nature Conservancy is a global conservation organization dedicated to conserving the lands and waters on which all life depends. Guided by science, we create innovative, on-the-ground solutions such as Community Resilience Building to our world’s toughest challenges so that nature and people can thrive together. We are tackling climate change, conserving lands, waters and oceans at an unprecedented scale, providing food and water sustainably and helping make cities more sustainable. Working in 72 countries, we use a collaborative approach that engages local communities, governments, the private sector, and other partners. To learn more, visit www.nature.org or follow @nature_press on Twitter.

PRESS RELEASE For Immediate Release: March 30, 2022

Infrastructure Bank Awards $827,000 In Water Quality Grants To 4 Water Systems Across Rhode Island

PROVIDENCE, R.I. – Rhode Island Infrastructure Bank (Infrastructure Bank) today announced the award of $827,000 in water quality grants to 4 public water systems across Rhode Island. Awards come from the Bank’s Water Quality Protection Charge program, which makes funds available to public drinking water suppliers to complete projects that protect sources of drinking water.

· $28,500 grant to the Pawtucket Water Supply Board for the purchase of a conservation easement and right of first refusal for watershed property adjacent to Pawtucket Water’s reservoir in Cumberland.

· $672,000 grant to the Kent County Water Authority for the purchase of two parcels in the Town of Coventry and Hopkins Hill water main looping and re-servicing.

· $2,700 grant to the Richmond Water Supply Board for engineering costs associated with the design and permitting of a water treatment system.

· $123,900 grant to the Westerly Water Department for the development of a Water Supply System Management Plan, a vulnerability assessment, and a dead-end looping project on Spray Rock Road.

“Rhode Island’s communities, residents, and businesses depend on the reliable supply of clean drinking water, and these grants will allow water suppliers across the state to invest in important water quality protection projects,” said Rhode Island Infrastructure Bank CEO Jeffrey R. Diehl.

Through our drinking water programs, the Infrastructure Bank has provided $647 million in loans and grants for drinking water projects across the state.

# # #

About the Rhode Island Infrastructure Bank

Rhode Island Infrastructure Bank is Rhode Island’s central hub for financing infrastructure improvements for municipalities, businesses, and homeowners. We leverage capital in a revolving fund to offer innovative financing for an array of infrastructure-based projects including water and wastewater, road and bridge, energy efficiency and renewable energy, and brownfield remediation. These quality-of-life projects improve the State’s infrastructure, create jobs, promote economic development, and enhance the environment. www.riib.org – Facebook:

@RIinfrastructure – Twitter:

@RI_InfraBank

Infrastructure Bank Announces $810,000 In Financing & Principal Forgiveness For Ponaganset High School Water System Upgrades

PROVIDENCE, R.I. – Rhode Island Infrastructure Bank (Infrastructure Bank) today announced an $810,000 loan and $200,000 in principal forgiveness for safe drinking water upgrades to Ponaganset High School’s water system. The project is being financed via the Drinking Water State Revolving Fund (DWSRF), which provides below-market interest rate loans to community public water systems, nonprofit noncommunity public water systems, privately organized water suppliers, and local governmental units to complete water infrastructure projects.

Upgrades to Ponaganset High School’s water system will include:

“Rhode Island’s many smaller water systems, like Ponaganset High School’s system, lack a broad base of rate payers to finance necessary, but often expensive system upgrades,” said Rhode Island Infrastructure Bank CEO Jeffrey R. Diehl. “That’s why the Infrastructure Bank is pleased to offer the Foster Glocester School District low-cost financing and principal forgiveness to allow for needed upgrades to ensure the continued supply of safe drinking water at Ponaganset High School.”

“I want to thank Rhode Island Infrastructure Bank for working with us to help finance these needed upgrades to Ponaganset High School’s water system,” said Dr. Michael Barnes, Superintendent of the Foster-Glocester Regional School District. “Our Ponaganset High students, teachers, and staff rely on safe drinking water, and these upgrades will help to ensure just that for decades to come.”

Since the inception of the DWSRF, the Infrastructure Bank has provided $450 million in loans to Rhode Island’s public water systems.

# # #

About the Rhode Island Infrastructure Bank

Rhode Island Infrastructure Bank is Rhode Island’s central hub for financing infrastructure improvements for municipalities, businesses, and homeowners. We leverage capital in a revolving fund to offer innovative financing for an array of infrastructure-based projects including water and wastewater, road and bridge, energy efficiency and renewable energy, and brownfield remediation. These quality-of-life projects improve the State’s infrastructure, create jobs, promote economic development, and enhance the environment. www.riib.org – Facebook:

@RIinfrastructure – Twitter:

@RI_InfraBank

PROVIDENCE, R.I. – Rhode Island Infrastructure Bank (Infrastructure Bank) today announced a $20 million loan to the Kent County Water Authority, enabling the Authority to move forward with the construction of a new energy efficient administration and maintenance facility in West Greenwich. Financing was provided through the Bank’s Drinking Water State Revolving Fund and Efficient Buildings Fund programs.

“We have significantly outgrown our current facility, and that is why we are so pleased to partner with the Infrastructure Bank on a $20 million financing package that will allow us to build a brand new, state -of-the-art energy efficient administration and maintenance facility to better serve our customers,” said David L. Simmons, PE, Executive Director and Chief Engineer of Kent County Water Authority. “In addition to meeting the spatial needs for future growth and an enhanced customer service experience, we are excited about the many energy efficiency features that will be integrated into the new building including a variable refrigerant flow (VRF) system, LED lighting, and enhanced insulation, just to name a few. In addition, the new facility will feature solar panels and charging stations for a fleet of electric vehicles. Combined, these elements will result in significant energy cost savings for the Authority and our customers while simultaneously moving toward our 100/100 goal to provide 100 % of the water service utilizing 100 % renewable energy sources. We want to thank the Infrastructure Bank for working with us to help make this important project a reality.”

“There is nothing more fundamental to Rhode Island’s communities, residents, and businesses than the reliable supply of clean, safe drinking water and that is why we are pleased to make this $20 million loan to enable the Kent County Water Authority to construct their new administration and maintenance facility,” said Infrastructure Bank CEO Jeffrey R. Diehl. “Through the combination of our Drinking Water State Revolving Fund and Efficient Buildings Fund programs, this loan will allow the Authority to continue to supply drinking water to their customers for decades to come, while also delivering energy cost savings.”

About Rhode Island Infrastructure Bank:

Rhode Island Infrastructure Bank is Rhode Island’s central hub for financing infrastructure improvements for municipalities, businesses, and homeowners. We leverage capital in a revolving fund to offer innovative financing for an array of infrastructure-based projects including water and wastewater, road and bridge, energy efficiency and renewable energy, and brownfield remediation. These quality of life projects improve the State’s infrastructure, create jobs, promote economic development and enhance the environment. For more information, please visit www.riib.org – Facebook: @RIinfrastructure – Twitter: @RI_InfraBank

About the Kent County Water Authority

The Kent County Water Authority supplies and distributes water services on a retail basis to residential, commercial, industrial, and other consumers within reach of its existing infrastructure within Kent County and a portion of Cranston, Scituate, and a small area of North Kingstown. The Authority provides service to over 87,000 inhabitants through 26,700 service connections and 457 miles of water main. kentcountywater.org

PROVIDENCE, R.I. – Today, Rhode Island Infrastructure Bank (Infrastructure Bank) released the Resilient Rhody 3 Year Impact Report detailing progress that has been made by state agency and municipal partners in turning the original 2018 Resilient Rhody report’s recommendations into concrete actions including infrastructure upgrades, coordinated planning, and financing of resilience projects.

Resilient Rhody 3 Year Impact Report highlights:

“Three years ago, a broad coalition of more than 50 stakeholders from state agencies, to municipalities, to non-profits came together to research and release Resilient Rhody. This was Rhode Island’s first comprehensive strategy on the impacts of climate change and actionable strategies to increase resilience in the face of threats to our infrastructure, environment, and public health,” said Jeffrey Diehl, CEO of the Infrastructure Bank. “Given the serious impacts identified in Resilient Rhody, allowing the report to gather dust on a shelf was simply not an option. Rather, as detailed in the Resilient Rhody 3 Year Impact Report, state agency and municipal partners have made real progress increasing resilience. For example, the Infrastructure Bank’s Municipal Resilience Program has worked with 20 municipalities who have participated in workshops led by The Nature Conservancy and the Bank to identify key projects. Through $2.5 million in action grants, we have helped municipal partners bring 22 projects to reality and mobilized an additional $6 million in funding for other resiliency projects like reducing stormwater runoff into Almy Pond in Newport, and constructing a bio-retention stormwater system to reduce flooding and minimize bacterial pollution in Warwick’s Greenwich Bay.”

“From sea level rise to increased flooding events, there is no question that Rhode Island is already feeling the impacts of climate change and that these impacts will only get worse if we fail to take action” said Terrence Gray, Acting Director of the Rhode Island Department of Environmental Management (RIDEM). “That is why RIDEM has been deeply engaged in resilience work since the release of the original Resilient Rhody report in 2018. For example, Resilient Rhody noted the vulnerability of many of our state’s wastewater treatment plants to flooding events that could overwhelm these systems and lead to sewage overflows into our streams, rivers, and Narragansett Bay. To address this, RIDEM led vulnerability assessments of all major treatment plants, and through our $5-million Wastewater Treatment Facility Resilience Fund we invested in hardening improvements at plants in East Greenwich and Woonsocket. This is just one of many actions taken by state agency partners that are detailed in the Resilient Rhody 3 Year Impact Report. While we collectively have much work left to do, we are making progress in ways both big and small towards building a more resilient Rhody.”

Click here for a PDF copy of the full Resilient Rhody 3 Year Impact Report.

About the Rhode Island Infrastructure Bank

Rhode Island Infrastructure Bank is Rhode Island’s central hub for financing infrastructure improvements for municipalities, businesses, and homeowners. We leverage capital in a revolving fund to offer innovative financing for an array of infrastructure-based projects including water and wastewater, road and bridge, energy efficiency and renewable energy, and brownfield remediation. These quality-of-life projects improve the State’s infrastructure, create jobs, promote economic development, and enhance the environment. www.riib.org – Facebook: @RIinfrastructure – Twitter: @RI_InfraBank

PROVIDENCE, R.I. – Rhode Island Infrastructure Bank (Infrastructure Bank) today announced the creation of a new pilot “Regional Resilience Coordinator” position to provide dedicated technical assistance to Aquidneck Island’s municipalities to implement climate resiliency investments. The hiring of this two-year pilot position has been made possible thanks to the support of the van Beuren Charitable Foundation.

“Through our Municipal Resilience Program work with Newport, Middletown, and Portsmouth, each community has identified limited staff capacity and technical expertise as barriers to advancing climate resilience projects,” said Jeffrey R. Diehl, Executive Director and Chief Executive Officer of the Bank. “Thanks to generous grant funding provided by the van Beuren Charitable Foundation, the Infrastructure Bank will be hiring an Aquidneck Island Regional Resilience Coordinator to better facilitate strategic infrastructure investments to increase the island’s resilience to the impacts of climate change including sea level rise, storm water runoff, and flooding events. We are excited to offer this new resource and believe it will serve as a statewide model for regional collaboration.”

For those interested in the two-year pilot Aquidneck Island Regional Resilience Coordinator position, a detailed job description and how to apply instructions can be found here.

About the Rhode Island Infrastructure Bank

Rhode Island Infrastructure Bank is Rhode Island’s central hub for financing infrastructure improvements for municipalities, businesses, and homeowners. We leverage capital in a revolving fund to offer innovative financing for an array of infrastructure-based projects including water and wastewater, road and bridge, energy efficiency and renewable energy, and brownfield remediation. These quality-of-life projects improve the State’s infrastructure, create jobs, promote economic development, and enhance the environment. www.riib.org – Facebook:

@RIinfrastructure – Twitter:

@RI_InfraBank

PROVIDENCE, R.I. – Rhode Island Infrastructure Bank (Infrastructure Bank) today announced $205,000 in bridge financing and an $83,000 Stormwater Project Accelerator grant to enable Groundwork Rhode Island to complete a new community composting facility and vegetation garden at 34 Fuller Street and 37 Westfield Street in Providence. Funds will be used to install a comprehensive below-grade stormwater management system and corresponding site remediation efforts on the two abutting properties.

“Rhode Island Infrastructure Bank is pleased to be providing Groundwork Rhode Island with the financing and grant resources they need to expand their successful community composting program,” said Infrastructure Bank CEO Jeffrey R. Diehl. “Groundwork had identified a promising site for an expanded composting facility, but soil contamination and the lack of stormwater management systems to control potentially polluted stormwater runoff was holding the project back. With this $288,000 package of bridge financing and a Stormwater Project Accelerator Grant, Groundwork will now be able to complete site remediation and stormwater management work to make their new community composting facility and vegetation garden a reality.”

“Groundwork Rhode Island deeply appreciates the financing and grant resources the Infrastructure Bank is providing so that we can complete construction of our new community composting facility and vegetation garden,” said Amelia Rose, Executive Director. “The Infrastructure Bank has been an incredible partner, helping us work through site preparation, technical, engineering, and financing issues to make this project a reality. A project that when completed will allow more Providence residences, restaurants, and institutions to take advantage of composting by recycling organic materials that would otherwise end up in the landfill.”

About Rhode Island Infrastructure Bank:

Rhode Island Infrastructure Bank is Rhode Island’s central hub for financing infrastructure improvements for municipalities, businesses, and homeowners. We leverage capital in a revolving fund to offer innovative financing for an array of infrastructure-based projects including water and wastewater, road and bridge, energy efficiency and renewable energy, and brownfield remediation. These quality of life projects improve the State’s infrastructure, create jobs, promote economic development and enhance the environment. For more information, please visit www.riib.org__

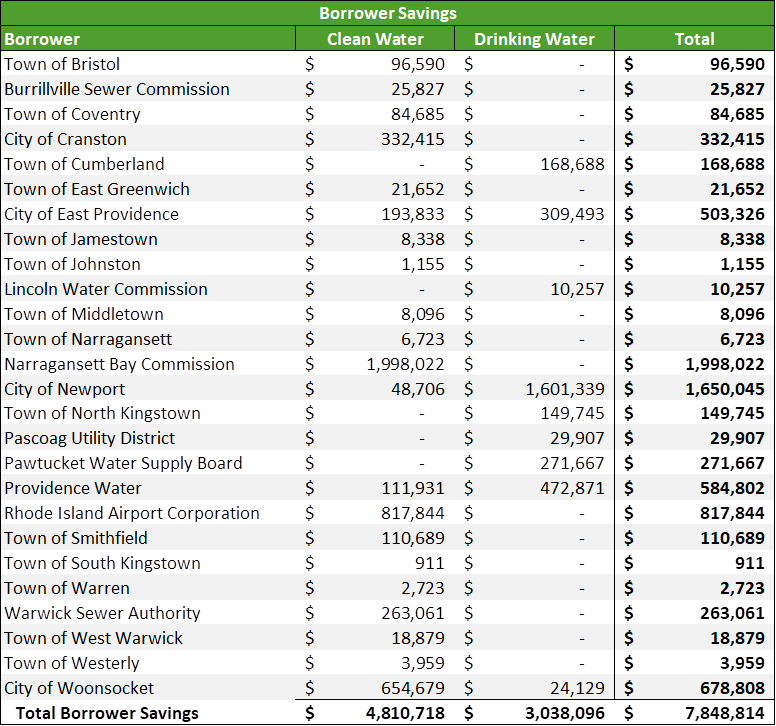

PROVIDENCE, R.I. – Rhode Island Infrastructure Bank (Infrastructure Bank) today announced total savings of $6.4 million from a recent refinancing of Clean Water and Safe Drinking Water State Revolving Fund bonds. These savings will be returned to the Bank’s municipal and quasi-public clients, including:

“We were able to take advantage of the current low interest rate environment and favorable bond market conditions to refinance outstanding bonds and significantly lower our costs, generating savings for our municipal and quasi-public clients, whose loans were originally funded with these bonds,” said Jeffrey R. Diehl, Executive Director and CEO of the Bank. “We are pleased to be returning these savings directly to 27 cities, towns, and quasi-public utilities across Rhode Island. Savings that can be reinvested in other clean or drinking water infrastructure projects.”

About Rhode Island Infrastructure Bank:

Rhode Island Infrastructure Bank is Rhode Island’s central hub for financing infrastructure improvements for municipalities, businesses, and homeowners. We leverage capital in a revolving fund to offer innovative financing for an array of infrastructure-based projects including water and wastewater, road and bridge, energy efficiency and renewable energy, and brownfield remediation. These quality of life projects improve the State’s infrastructure, create jobs, promote economic development and enhance the environment. For more information, please visit www.riib.org__

PROVIDENCE, RI – Rhode Island Infrastructure Bank (the Bank) announced today that it is offering $127.965 million* of State Revolving Fund Refunding Revenue Bonds (Federally Taxable) on August 17, 2021, which are expected to be delivered on September 1, 2021.

The bonds will be offered via negotiated sale with Raymond James and Hilltop Securities serving as the senior manager and municipal advisor, respectively, for the transaction. The bonds are rated “AAA” by both S&P Global Ratings Services and Fitch Ratings.

“Our funding optimization strategy together with the current interest-rate environment presents a unique opportunity for the Bank to refinance some of our existing debt and deliver substantial savings to our clients” said Jeffrey R. Diehl, Executive Director and Chief Executive Officer of the Bank. “In undertaking the refunding, we anticipate providing upfront cash payments of approximately $6.2 million to 25 borrowers that utilized our clean and drinking water programs. These savings will help accelerate investment in other eligible clean or drinking water projects.”

Additional information about the upcoming deal, the Bank’s previous projects, and more can be found at www.riibbonds.com, an investor relations platform powered by BondLink.

*Preliminary and subject to change. The size, timing, and structure of the anticipated transaction remain subject to market conditions and the Bank reserves the right to change or modify its plans as it deems appropriate. The Bank is under no obligation to pursue any transaction, any particular structure, or issuance of any bonds. There is no guarantee any contemplated transaction or structure will be completed.

To receive more information, please contact your financial advisor or broker. This press release is not an offer to sell or a solicitation of an offer to buy bonds. Bonds may only be purchased through a registered broker. Carefully review the preliminary official statement.

About Rhode Island Infrastructure Bank

Rhode Island Infrastructure Bank is Rhode Island’s central hub for financing infrastructure improvements for municipalities, businesses, and homeowners. We leverage capital in a revolving fund to offer innovative financing for an array of infrastructure-based projects including water and wastewater, road and bridge, energy efficiency and renewable energy, stormwater and resiliency and brownfield remediation. These quality-of-life projects improve the State’s infrastructure, create jobs, promote economic development, and enhance the environment. For more information, please visit www.riib.org.

PROVIDENCE, R.I. – Rhode Island Infrastructure Bank (Infrastructure Bank) today announced the approval of up to a $400,000 loan from the Efficient Buildings Fund to allow the Coventry Fire District to purchase and install energy efficient light emitting diode (LED) streetlights.

“This loan from the Infrastructure Bank will allow us to install over 900 new energy efficient streetlights across our service area,” said Coventry Fire District Board Chairman Bryan Testen. “These LED streetlights will use at least 75% less energy and last three times longer than our existing streetlights. The taxpayers will benefit from better street lighting which increases public safety, and the annual cost savings will result in a tax decrease - that's a great combination. It’s a smart, energy conscious investment in our district’s road infrastructure, and we thank the Infrastructure Bank for their help in financing this project.”

“The Efficient Buildings Fund is a great and flexible resource for municipalities to upgrade the energy efficiency of all kinds of infrastructure from their buildings to streetlights,” said Jeffrey R. Diehl, CEO of Rhode Island Infrastructure Bank. “We are pleased to provide a below market loan to the Coventry Fire District to finance their streetlight upgrade project which will deliver improved lighting and long-term savings for the residents of the district.”

About Rhode Island Infrastructure Bank:

Rhode Island Infrastructure Bank is Rhode Island’s central hub for financing infrastructure improvements for municipalities, businesses, and homeowners. We leverage capital in a revolving fund to offer innovative financing for an array of infrastructure-based projects including water and wastewater, road and bridge, energy efficiency and renewable energy, and brownfield remediation. These quality of life projects improve the State’s infrastructure, create jobs, promote economic development and enhance the environment. For more information, please visit www.riib.org__

PROVIDENCE, R.I. – Rhode Island Infrastructure Bank (Infrastructure Bank) today announced the approval of a $400,000 loan from the Brownfields Revolving Loan Fund to finance environmental remediation work as part of the larger Nexus Lofts redevelopment project located at 49 North Union Street, in downtown Pawtucket. The redevelopment will include 27 affordable market-rate apartments with ground floor office and/or retail.

“Many commercial redevelopment sites in Rhode Island require some form of brownfield remediation, and that’s precisely what the Brownfields Revolving Loan Fund program is for,” said Jeffrey R. Diehl, CEO of Rhode Island Infrastructure Bank. “This $400,000 loan for site remediation work at the Nexus Lofts project will help catalyze further development in the surrounding buildings. We are pleased to help finance a portion of this key project for the continued revitalization of downtown Pawtucket.”

“This brownfields loan is a critical part of our overall project financing and site redevelopment plan,” said Co-Developer Michael Leshinsky. “We want to thank the team at the Infrastructure Bank for working with us to finance the site remediation we need to complete in order to unlock the full potential of our Nexus Lofts project.”

About Rhode Island Infrastructure Bank:

Rhode Island Infrastructure Bank is Rhode Island’s central hub for financing infrastructure improvements for municipalities, businesses, and homeowners. We leverage capital in a revolving fund to offer innovative financing for an array of infrastructure-based projects including water and wastewater, road and bridge, energy efficiency and renewable energy, and brownfield remediation. These quality of life projects improve the State’s infrastructure, create jobs, promote economic development and enhance the environment. For more information, please visit www.riib.org__

PROVIDENCE, R.I. – Rhode Island Infrastructure Bank (Infrastructure Bank) today announced more than $3 million in financing and loan forgiveness for safe drinking water upgrade projects for 5 small and community water system providers across the state. The projects are being financed via the Drinking Water State Revolving Fund (DWSRF) program, which provides below-market interest rate loans to community public water systems, nonprofit noncommunity public water systems, privately organized water suppliers, and local governmental units to complete water infrastructure projects.

"Rhode Island's many smaller water systems often lack the broad base of rate payers to finance needed, but often expensive, system upgrade projects on their own," said Rhode Island Infrastructure Bank CEO Jeffrey R. Diehl. "That's why the Infrastructure Bank is pleased to offer low-cost financing and loan forgiveness through the Drinking Water State Revolving Fund to allow our state's smaller water system providers to make the investments needed to ensure the continued supply of safe drinking water."

Since the inception of the DWSRF, the Infrastructure Bank has provided $450 million in loans to Rhode Island's public water systems.

About Rhode Island Infrastructure Bank:

Rhode Island Infrastructure Bank is Rhode Island’s central hub for financing infrastructure improvements for municipalities, businesses, and homeowners. We leverage capital in a revolving fund to offer innovative financing for an array of infrastructure-based projects including water and wastewater, road and bridge, energy efficiency and renewable energy, and brownfield remediation. These quality of life projects improve the State’s infrastructure, create jobs, promote economic development and enhance the environment. For more information, please visit www.riib.org__

PROVIDENCE, R.I. – Rhode Island Infrastructure Bank (Infrastructure Bank) today announced three energy efficiency construction projects receiving a total of more than $1.7 million in financing through the Bank’s innovative Commercial Property Assessed Clean Energy (C-PACE) program:

“The Infrastructure Bank is pleased to help make these solar, water conservation, and energy efficiency construction projects happen via our C-PACE program,” said Jeffrey R. Diehl, CEO. “As Rhode Island’s commercial building owners look to upgrade their properties to make them more efficient, C-PACE is an excellent tool that can provide up to 100% project financing. That means no upfront, out-of-pocket costs, and no personal guarantees are needed to make these projects a reality. Repayment occurs via an assessment on the property and typically the energy cost savings from these upgrades outweigh the payment.”

“Greenworks Lending’s mission is to fund projects that have a positive impact on buildings, the businesses that occupy them, local communities and the environment,” said It should be attributed to Michael Doty, Director - New England, Greenworks Lending. “These two projects in particular had significant environmental and economic benefits. They are a perfect example of doing well by doing good.”

“Our congregation wanted to reduce our carbon footprint and our energy costs, so we began looking into solar as an option for our parish,” said Rev. David C. Procaccini, Pastor of St. Francis de Sales Parish in North Kingstown. “The upfront costs of solar installations can be excessive, but thanks to the Infrastructure Bank, we found a financing option through the Bank’s C-PACE program. We’re thrilled to be able to complete this project, reduce our carbon footprint, and save energy cost. We are truly grateful to the Infrastructure Bank for their help making this project a reality.”

“We were interested in the possibility of roof mounted solar, but we had just done a full remodel of our store. Without C-PACE financing this project would not have been possible. With no money out of pocket and C-PACE covering installation costs we will be cash flow positive from day one,” said Mark McQuade, General Manager of Ace McQuade’s in Westerly. “I’m looking forward to reduced electricity costs for years to come, and our customers can know they are shopping at an environmentally friendly hardware store.”

About Rhode Island Infrastructure Bank:

Rhode Island Infrastructure Bank is Rhode Island’s central hub for financing infrastructure improvements for municipalities, businesses, and homeowners. We leverage capital in a revolving fund to offer innovative financing for an array of infrastructure-based projects including water and wastewater, road and bridge, energy efficiency and renewable energy, and brownfield remediation. These quality of life projects improve the State’s infrastructure, create jobs, promote economic development and enhance the environment. For more information, please visit www.riib.org__

PROVIDENCE, R.I. – Rhode Island Infrastructure Bank announced $1,500,000 in action grants for participants of the 2020 Resilient Rhody Municipal Resilience Program (MRP). Communities prioritized local actions through the program and will now use grant funds for implementation of projects that will increase their climate resilience.

“The Infrastructure Bank is committed to working with our municipal partners to accelerate investment in critical infrastructure and nature-based solutions that better prepare Rhode Island communities for a changing climate” said Jeffrey R. Diehl, CEO of Rhode Island Infrastructure Bank. “We look forward to building on the success of the first two rounds of the program and strengthening relationships with communities statewide to proactively identify the resources needed to make needed resilience projects happen.”

With support from The Nature Conservancy, over the past 12 months municipalities completed Community Resilience Building workshops and developed a prioritized list of actionable plans and projects. Participating municipalities submitted proposals for action grants, with a 25% local match requirement. After a competitive review process, the selection committee recommended the following communities to receive funding for implementation:

The Bank also named six municipalities to participate in the 2021 round of the MRP. This is the third round of the program and the selected municipalities will complete Community Resilience Building workshops with The Nature Conservancy and receive designation as a Resilient Rhody Municipality upon successful completion of the program. They are then eligible to apply for 2021 Action Grants. 19 municipalities, or 49% of the state, are currently participating in the program.

Selected 2021 municipalities:

“The majority of infrastructure and assets at risk to climate change in Rhode Island are owned and managed by municipalities, but these communities often lack the staff capacity, funding, and expertise to plan and prioritize resilience projects,” said Shaun O’Rourke, managing director of program and business development at the Infrastructure Bank and the state’s chief resiliency officer. “Rising sea levels, increasing heat, and extreme storm events will have long-term effects on local infrastructure and residents. The Municipal Resilience Program is collaboratively building a statewide pipeline of priority projects with municipalities to more effectively and efficiently respond to these climate impacts that we are already experiencing.”

In 2020, The Nature Conservancy adapted the in-person, day-long Community Resilience Building Workshop to an entirely online format that will continue with the 6 municipalities chosen for 2021. “While we miss in-person connections, we are seeing community leaders enthusiastic to collaborate in response to and try to get ahead of the impacts of climate change,” said Sue AnderBois, The Nature Conservancy’s Climate and Energy Program Manager. “These action grants from RI Infrastructure Bank are a critical down payment to improve water quality, reduce air pollution and create healthier communities for generations to come.”

The MRP supports the goals outlined in the state’s Climate Resilience Action Strategy (Resilient Rhody) released by Governor Gina Raimondo in 2018. Resilient Rhody identified steps the state can take to protect against unexpected events, like severe weather, while addressing chronic environmental stresses, such as sea level rise and aging infrastructure. The MRP empowers cities and towns to evaluate each of their unique vulnerabilities to changing weather and severe weather events, while providing them with the funds necessary to take on specific resilience projects.

About Rhode Island Infrastructure Bank:

Rhode Island Infrastructure Bank is Rhode Island’s central hub for financing infrastructure improvements for municipalities, businesses, and homeowners. We leverage capital in a revolving fund to offer innovative financing for an array of infrastructure-based projects including water and wastewater, road and bridge, energy efficiency and renewable energy, and brownfield remediation. These quality of life projects improve the State’s infrastructure, create jobs, promote economic development and enhance the environment. For more information, please visit www.riib.org.

About The Nature Conservancy

The Nature Conservancy is a global conservation organization dedicated to conserving the lands and waters on which all life depends. Guided by science, we create innovative, on-the-ground solutions such as Community Resilience Building to our world’s toughest challenges so that nature and people can thrive together. We are tackling climate change, conserving lands, waters and oceans at an unprecedented scale, providing food and water sustainably and helping make cities more sustainable. Working in 72 countries, we use a collaborative approach that engages local communities, governments, the private sector, and other partners. To learn more, visit www.nature.org or follow @nature_press on Twitter.

PROVIDENCE, R.I. –Rhode Island Infrastructure Bank (Bank) today announced that infrastructure expert and respected business leader Vahid Ownjazayeri will serve as new Board Chair, taking over for outgoing Chair Merrill Sherman after six years of service to the Bank.

“The Infrastructure Bank is pleased to welcome Vahid Ownjazayeri as our new Board Chair,” said Jeffrey R. Diehl, CEO. “Vahid’s years of experience at Global Infrastructure Solutions Inc., AECOM, and the Shaw Group in the planning, financing, and construction of major environmental and transportation infrastructure projects will be a tremendous resource as we work to meet the infrastructure financing needs of Rhode Island’s municipalities and commercial property owners.”

Continued Diehl, “I also want to thank Merrill Sherman for her six years of service to the Infrastructure Bank. Thanks to her leadership, counsel, and strategic vision, we have transformed the Bank into a 21st century organization focused on solving the infrastructure investment needs of our communities. Under her tutelage, we have expanded our lending programs by $700 million, and saved our customers $149 million in lower interest and energy costs, while creating and supporting over 16,000 jobs. Merrill’s decades of experience in finance and banking have been invaluable. She has been a truly dedicated Board member, a mentor and a friend, and we thank her for her service to the Infrastructure bank.”

Vahid Ownjazayeri of Providence is a Managing Director at Global Infrastructure Solutions Inc. He previously served as President of AECOM’s Global Infrastructure Business, and then as its Chief Growth and Strategy officer. Prior to that he was the President of the Commercial, State, and Local division of The Shaw Group. He holds a Master's degree in structural engineering and a Bachelor's degree in civil engineering from Northeastern University.

“The Bank is doing absolutely critical work to ensure that Rhode Island’s cities and towns have the project management and financing tools they need to invest in infrastructure projects that increase resiliency, while also creating good-paying construction jobs,” said Ownjazayeri. “I look forward to sharing my experience so the Bank can continue to grow and fulfill its mission to support and finance investments in Rhode Island’s infrastructure. I would like to thank Merrill Sherman for her service dedicated to the Bank and her work to champion this organization through six years of growth. I look forward to building off of her momentum and important work."

“Serving as Board Chair for the past six years, I am proud to have helped guide the growth and continued success of the Bank’s many infrastructure financing programs that are making our communities more resilient, more energy efficient, and creating construction and green economy jobs that contribute to the Rhode Island economy,” said Merrill Sherman. “Rhode Island still has much work to do to build, repair, and preserve critical transportation, water, clean energy and resiliency infrastructure projects. I am confident the Infrastructure Bank, under the leadership of Vahid Ownjazayeri as Board Chair and Jeff Diehl as CEO, will be there to assist our municipalities finance these much-needed investments.”

About Rhode Island Infrastructure Bank:

Rhode Island Infrastructure Bank is Rhode Island’s central hub for financing infrastructure improvements for municipalities, businesses, and homeowners. We leverage capital in a revolving fund to offer innovative financing for an array of infrastructure-based projects including water and wastewater, road and bridge, energy efficiency and renewable energy, and brownfield remediation. These quality of life projects improve the State’s infrastructure, create jobs, promote economic development and enhance the environment. For more information, please visit www.riib.org.

PROVIDENCE, R.I. – Rhode Island Infrastructure Bank (Infrastructure Bank) today announced the promotion of Shaun O'Rourke to Managing Director, Program and Business Development. Mr. O’Rourke assumes the new role after 4 years serving as the Infrastructure Bank’s Director of Stormwater and Resiliency. He is replacing Michael Baer, who is leaving to pursue a new position in the private sector after 6 years of service to the Infrastructure Bank.

“We’d like to thank Michael for his years of work in leading new program and business development for the Infrastructure Bank,” said Jeffrey R. Diehl, CEO. “Thanks to Michael’s work in developing our new investment programs and building connections with Rhode Island’s municipal leaders and commercial property owners, the Bank has invested over $700 million in water, road, and clean energy infrastructure projects that have supported 16,000 jobs, and saved borrowers nearly $200 million through lower financing costs and energy savings. We wish Michael the best of luck in his new endeavor.”

Continued Diehl, “The Infrastructure Bank is pleased to promote Shaun O'Rourke to Managing Director, Program and Business Development, based on his strong record of running our stormwater and resiliency programs. Shaun is a true climate change leader who has been focused on ways to accelerate the state and its municipalities’ transition to clean energy and greater climate resiliency as Rhode Island’s first gubernatorial appointed Chief Resiliency Officer. Bringing those skills and experience to his new role, we look forward to continuing to grow our portfolio of infrastructure financing solutions for our state’s cities and towns, businesses, and homeowners.”

About Rhode Island Infrastructure Bank:

Rhode Island Infrastructure Bank is Rhode Island’s central hub for financing infrastructure improvements for municipalities, businesses, and homeowners. We leverage capital in a revolving fund to offer innovative financing for an array of infrastructure-based projects including water and wastewater, road and bridge, energy efficiency and renewable energy, and brownfield remediation. These quality of life projects improve the State’s infrastructure, create jobs, promote economic development and enhance the environment. For more information, please visit www.riib.org.

PROVIDENCE, R.I. – Rhode Island Infrastructure Bank and The Nature Conservancy are proud to announce the opening of the application period for the 2021 Municipal Resilience Program (MRP). Building off the program’s success over the past two years, the Municipal Resilience Program aims to equip municipalities with the tools necessary to assess their vulnerability to climate change, while providing the necessary funding to take on specific community resilience projects. Successful applicants gain access to technical assistance from The Nature Conservancy and the opportunity to apply for action grants through the Infrastructure Bank. The Bank has committed $2 million in grant funding for projects identified in the 2019 and 2020 MRP rounds and additional funding will be available for participating municipalities in 2021.

“The Infrastructure Bank is committed to assisting communities invest in green infrastructure that withstands and adapts to a changing climate” said Jeffrey R. Diehl, CEO of Rhode Island Infrastructure Bank. “We look forward to continuing this important program and strengthening our partnership with communities as they prepare and invest in critical infrastructure.”

Since the program’s inception in 2019, Barrington, Bristol, Little Compton, Newport, Middletown, Pawtucket/Central Falls, Portsmouth, South Kingstown, Warwick, Warren, Westerly and Woonsocket completed Community Resilience Building workshops. During the workshop process, participating municipalities developed a list of priority projects and subsequently applied to the Bank for a share of action grant funding, which require a 25% local match. A range of resilience projects have emerged from the workshops including; stormwater management, coastal restoration, dam repair/removal, tree planting, culvert repair, and flood mitigation. Grant awards for projects identified in the 2021 MRP process will be announced in early 2022.

“Municipalities are taking action to combat rising sea levels and increased storms that will have long-term effects on local infrastructure and residents,” said Shaun O’Rourke, director of stormwater and resiliency at the Infrastructure Bank and the state’s Chief Resiliency Officer. “The Municipal Resilience Program has demonstrated the impact of identifying and accelerating investment in local priority actions through planning and project pipeline building.”

“The MRP workshops are driving community-wide conversations about on-the-ground efforts to address climate change, such as how to make sure our roads, culverts and wastewater systems can handle more frequent and intense storms,” said Sue AnderBois, The Nature Conservancy’s Climate and Energy Program Manager. “Yesterday’s solutions aren’t working anymore. We are looking forward to working with more cities and towns in 2021 to make Rhode Islanders safer and more resilient to climate change.”

All Rhode Island cities and towns can apply for the 2021 Municipal Resilience Program here. Municipalities are encouraged to apply as regional clusters or multi-municipal groups. Regional groups need not share a boundary but should be able to work well together based on their geography as well as other commonalities. MRP workshops are scheduled to start in May 2021 and will likely be conducted online. Applications are due no later than 4 PM on January 29th, 2020. At least 5 municipalities will be selected for the 2021 round of the program.

About Rhode Island Infrastructure Bank:

Rhode Island Infrastructure Bank is Rhode Island’s central hub for financing infrastructure improvements for municipalities, businesses, and homeowners. We leverage capital in a revolving fund to offer innovative financing for an array of infrastructure-based projects including water and wastewater, road and bridge, energy efficiency and renewable energy, and brownfield remediation. These quality of life projects improve the State’s infrastructure, create jobs, promote economic development and enhance the environment. For more information, please visit www.riib.org.

PROVIDENCE, R.I. – Rhode Island Infrastructure Bank (Infrastructure Bank) announced $1.9 million in principal forgiveness loans through the Drinking Water State Revolving Fund (DWSRF) for small water systems in Tiverton, Chepachet, and Richmond. Upon completion, the three projects will improve water quality, system resilience and lessen the financial burden on the communities.

Hillsdale Housing Cooperative, a residential community located in Richmond for those aged 55 and older, received a $1,230,919 principal forgiveness loan. The cooperative utilized the forgivable loan to fund comprehensive system and distribution upgrades to its deteriorating community drinking water system.

Lawrence Sunset Cove Association, a homeowner’s association located in Tiverton, received a $576,100 principal forgiveness loan to improve its water supply, treatment technologies and distribution systems. These preemptive upgrades will ensure that the well-based community water system continues to deliver safe, and quality water to residents.

The Harmony Hill School received a $100,000 principal forgiveness loan to fund improvements to its drinking water distribution, treatment and pumping infrastructure. Harmony Hill School is a day and residential youth developmental facility located in Glocester.

“A number of rural Rhode Island communities gain access to drinking water through small drinking water systems,” said Jeffrey R. Diehl, CEO of the Infrastructure Bank. “Improvements to these aging systems can be cost prohibitive, which is why the Infrastructure Bank and EPA strive to provide these small and, often, disadvantaged communities with loan forgiveness. Ultimately, access to clean drinking water is an inherent right of all Rhode Islander’s - irrespective of their income levels.”

According to the Environmental Protection Agency, 90% of New England's drinking water systems are small or disadvantaged. Of this 90%, a vast majority utilize ground water sources. Small systems provide drinking water to less than 3,300 people and often have limited financial and operational resources compared to larger systems.

The Drinking Water State Revolving Fund is a financing program that provides below-market interest rate loans to public and private drinking water systems to complete water infrastructure upgrades. To date, the Drinking Water State Revolving Fund has provided more than $615 million in low-cost project-financing to 29 water systems across the State. In turn, these dollars drive public health improvements and support more than 17,500 well-paying jobs across Rhode Island’s building trades.

About Rhode Island Infrastructure Bank:

Rhode Island Infrastructure Bank is Rhode Island’s central hub for financing infrastructure improvements for municipalities, businesses, and homeowners. We leverage capital in a revolving fund to offer innovative financing for an array of infrastructure-based projects including water and wastewater, road and bridge, energy efficiency and renewable energy, and brownfield remediation. These quality of life projects improve the State’s infrastructure, create jobs, promote economic development and enhance the environment. For more information, please visit www.riib.org.

PROVIDENCE, R.I. – Rhode Island Infrastructure Bank proudly announces the closing of $327,584 in financing for Green Line Apothecary in Providence. Through the Bank’s Commercial Property Assessed Clean Energy (C-PACE) program, the building owner was able to borrow against energy efficiency measures previously installed while increasing liquidity during a challenging economic environment.

“Rhode Island C-PACE affords building owners the opportunity to leverage energy efficiency and clean energy measures installed any time after July 2015,” said Jeffrey R. Diehl, CEO of Rhode Island Infrastructure Bank. “This allows C-PACE to support more local businesses and assist them in accessing capital during these difficult financial times.”

Green Line Apothecary’s building, located at 905 N Main Street in Providence, was retrofitted for energy efficiency in 2019 including the installation of LED lighting throughout, high efficiency HVAC equipment, and a building envelope upgrades that exceed building code requirements. These efficiency measures, completed by Lineage Corporation, will save the business over $7,500 a year on energy costs. Greenworks Lending provided the private capital for this C-PACE loan.

“At Green Line Apothecary, we are not just green in name only. Our modern version of the neighborhood drugstore means being engaged and responsible members of the communities we serve,” said Ken Procaccianti, President & Chief Operating Officer of Green Line Apothecary. “And practicing environmental sustainability is a crucial part to being a community steward. The Rhode Island C-PACE program enabled Green Line Apothecary, and its design & build firm Lineage Corporation, to implement significant energy efficient improvements to its Providence facility. Green Line now serves Rhode Island statewide and looks forward to working again with RI C-PACE, Greenworks Lending and Rhode Island Infrastructure Bank.”

With locations on Main Street in Wakefield and North Main Street in Providence, Green Line Apothecary is a pharmacy and soda fountain inspired by the vintage apothecary. Guests can experience their old-fashioned soda fountain and personal service while filling their prescription needs at their modern pharmacy.

About Rhode Island Infrastructure Bank:

Rhode Island Infrastructure Bank is Rhode Island’s central hub for financing infrastructure improvements for municipalities, businesses, and homeowners. We leverage capital in a revolving fund to offer innovative financing for an array of infrastructure-based projects including water and wastewater, road and bridge, energy efficiency and renewable energy, and brownfield remediation. These quality of life projects improve the State’s infrastructure, create jobs, promote economic development and enhance the environment. For more information, please visit www.riib.org.

About Rhode Island C-PACE

Rhode Island C-PACE is a program of the Rhode Island Infrastructure Bank that enables owners of commercial and industrial buildings to finance up to 100 percent of eligible energy efficiency, renewable energy, water conservation, and environmental health and safety improvements. Financing is provided by private capital providers at competitive rates with repayment terms that can span up to 25 years. For more information, visit www.ri-cpace.com.

About Greenworks Lending

Greenworks Lending is the largest provider of Commercial Property Assessed Clean Energy (C-PACE) financing in the country. Led by several of the industry’s founding policy developers and standard-setters, Greenworks Lending is a private capital provider uniquely dedicated to funding commercial real estate through C-PACE. Greenworks has provided financing to hundreds of commercial properties and is active in 23 states. Greenworks Lending’s C-PACE financing makes clean energy a smart financial decision for commercial property owners. For more information visit www.greenworkslending.com.

PROVIDENCE, R.I. – Rhode Island Infrastructure Bank (Infrastructure Bank) today announced $30 million in below-market rate financing through its Drinking Water State Revolving Fund (DWSRF) for projects across four borrowers, including the Town of Cumberland, the City of Newport, Providence Water Supply Board, and Smithfield Water Supply Board. By financing these projects through Infrastructure Bank loan programs, these clients will realize over $10.9 million in lifetime debt-service savings compared to borrowing independently from banks or the bond market.

“There is no greater natural resource than water,” said Jeffrey R. Diehl, CEO of Rhode Island Infrastructure Bank. “The Infrastructure Bank is proud to support local communities and drinking water systems as they take bold action to ensure that public drinking water remains safe and reliable for their residents and ratepayers.”

Providence Water received $19.1 million to finance its ongoing work to modernize its distribution infrastructure. To advance these efforts, Providence Water will continue to retrofit older water main pipes, as well as clean and line additional pipes in its system. As part of this loan, the Bank provided Providence Water with $9.75 million in loan forgiveness. This allows Providence Water to complete this critical work, while saving ratepayers money.

The City of Newport borrowed $4,131,000 to upgrade its system by rehabilitating water mains in the areas of Annandale Road, Narragansett Avenue, Thames Street, Spring Street and Roseneath Avenue. The project also calls for the installation of new valves, fittings, water services, curb stops and fire hydrants.

Through a $4 million loan, the Town of Cumberland and the Cumberland Water Department will be rehabilitating and replacing water mains. The Cumberland Water Department operates as an enterprise fund within the Town servicing roughly 23,000 people north of Marshall Avenue.

Smithfield Water Supply Board will be rehabilitating and recoating up to three existing water storage tanks with a $2,730,000 loan. The project will include removing and replacing existing coatings as well as installing water mixers and an advanced filtration system on the tanks at Island Woods, Rocky Hill and Burlingame. The Infrastructure Bank provided an innovative borrowing solution that afforded Smithfield maximum flexibility in executing the work while it conducts further studies to determine what additional repairs, if any, are necessary.

About Rhode Island Infrastructure Bank:

_Rhode Island Infrastructure Bank is Rhode Island’s central hub for financing infrastructure improvements for municipalities, businesses, and homeowners. We leverage capital in a revolving fund to offer innovative financing for an array of infrastructure-based projects including water and wastewater, road and bridge, energy efficiency and renewable energy, and brownfield remediation. These quality of life projects improve the State’s infrastructure, create jobs, promote economic development and enhance the environment. For more information, please visit www.riib.org._

PROVIDENCE, R.I. – The Rhode Island Commercial Property Assessed Clean Energy (C-PACE) program, a program of Rhode Island Infrastructure Bank, announced the closing of $6.4 million in financing with the Preserve Sporting Club & Residences. The Preserve is incorporating energy efficiency features into the construction of 18 condominium units. The Hilltop Lodge at The Preserve features a state-of-the-art, highly efficient HVAC system, energy efficient windows, LED lighting throughout the facility and a building envelope rating that exceeds standard code. The comprehensive upgrades, financed by Twain Financial Partners, will reduce annual energy expense by over 20%.