William Fazioli, Executive Director

Rhode Island Infrastructure Bank

Rhode Island Infrastructure Bank

Add this issuer to your watchlist to get alerts about important updates.

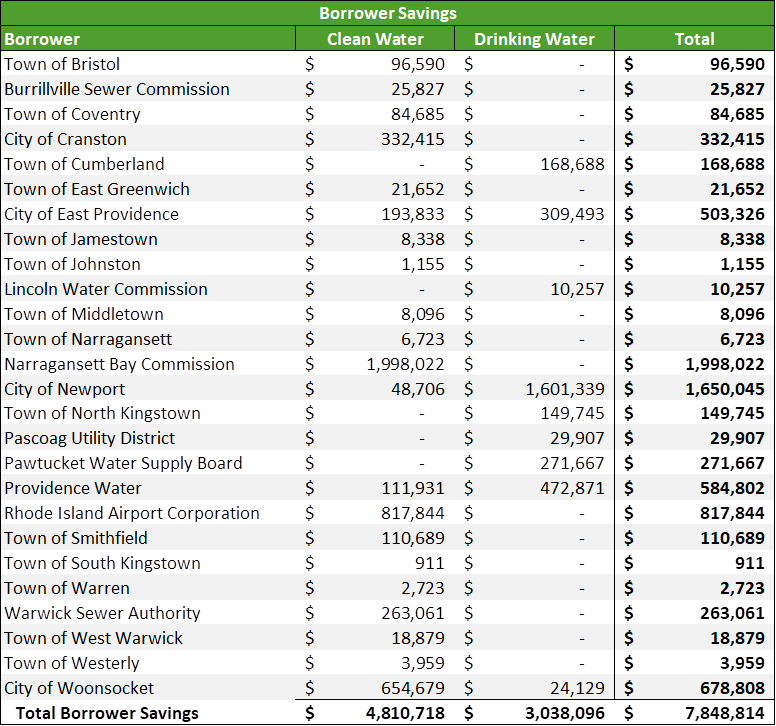

Rhode Island Infrastructure Bank (Infrastructure Bank) is proud to announce the closing of a Clean Water State Revolving Fund and Drinking Water State Revolving Fund bond refinancing transaction, with a principal value of $153.8 million. The transactions will generate $7.8 million of savings for 26 municipalities and utilities.

“Through proactive balance sheet management, the Infrastructure Bank monitors interest rate environments to identify opportunities to lower our cost of borrowing,” said Jeffrey R. Diehl, CEO of Rhode Island Infrastructure Bank. “By refinancing existing debt at lower interest rates, we can provide savings to our customers and maximize the amount of capital available to finance additional infrastructure projects.”

The refinancing of Drinking Water and Clean Water State Revolving Fund bonds is part of a strategic effort by the Bank to take advantage of low interest rates and provide financial savings to customers. This past July, the Bank completed a refinancing for Drinking Water State Revolving Fund bonds, which generated more than $550,000 of cash-savings for borrowers. In 2019, the Bank has created $8.4 million of cash-savings for borrowers.

“Ensuring that Rhode Islanders have access to, and can afford, clean water is core to the Infrastructure Bank’s mission and is important to every one of us,” said Rhode Island General Treasurer Seth Magaziner. “This refinancing of clean water debt will help Rhode Island cities and towns save millions of dollars, which can be used to create additional economic opportunity; so that Rhode Island remains a great place to work and live.”

Over the last five years, the Bank has provided $33.4 million in savings to borrowers by refinancing existing debt at lower interest rates.